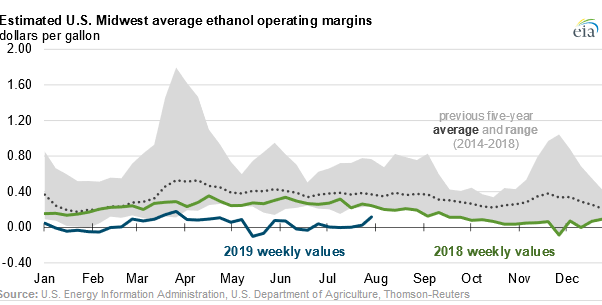

(WASHINGTON, DC) U.S. ethanol producers are watching their profit margins sink to multiyear lows. According to the latest data from the U.S. Energy Information Administration (EIA), estimated operating margins for corn-based fuel ethanol plants in the Midwest were averaging about 3.5 cents per gallon through the first half of the year. Those margins have fallen to near zero during June and July because of rising corn prices and high ethanol inventory levels. Lower operating margins mean some ethanol plants may cut or even pause production until conditions improve. EIA estimates operating margins for a dry mill corn ethanol plant of average capacity in the Midwest by taking the sum of the revenue generated from the sale of ethanol and co-products (like distillers’ dried grains and distillers’ corn oil) and subtracting variable and fixed costs associated with producing ethanol. Variable costs include corn feedstock and the natural gas used to produce thermal energy, along with an assumed fixed operating cost of 35 cents per gallon. Ethanol production has been high this year despite limited domestic demand growth. At current production rates, domestic ethanol blending into motor gasoline and fuel ethanol exports has not been able to absorb growing supplies, leading to oversupply. Fuel ethanol production and inventories have been either near or higher than their five-year averages for most of 2019, and both set new seasonal records in June and July. In its latest Short-Term Energy Outlook, EIA forecasts that U.S. ethanol production will average 1.03 million barrels per day this year, about two percent less than the last year. If realized, this will mark the first decrease in annual production since 2012. EIA expects that by 2020 excess ethanol supplies will be consumed and normal weather and harvest conditions will help production levels increase slightly to an average of about 1.05 million barrels per day.